Bloomsbury blog Should I invest all my money now, or ease in over time?

Bloomsbury blog post, 02 November 2025

One of the most common questions we hear from new clients is: "Should I invest all my money at once, or spread it out over time?" Deciding how to deploy an initial investment is an important step in your financial journey.

The two main strategies for deploying an initial investment are with a lump sum or dollar cost averaging (DCA).

Understanding the two strategies

Lump sum investing means putting your entire investment to work right away.

Dollar cost averaging involves dividing your investment into smaller amounts and investing them periodically. For example, instead of investing $10,000 all at once, you might invest $500 each month for 24 months.

If you invest $500 each month, when market prices are higher, you purchase fewer shares, and when market prices are lower, you purchase more. This reduces the volatility an investor experiences during the buying period, since less of their investment is exposed to market risk. For short-term or highly risk averse investors, DCA offers peace of mind.

The downside of DCA is that money not yet invested misses out on potential growth. Since returns come from taking on market risk, investing gradually usually means lower long-term returns. Markets tend to rise over time, so the longer your money is invested, the more opportunity it has to grow.

What the data shows

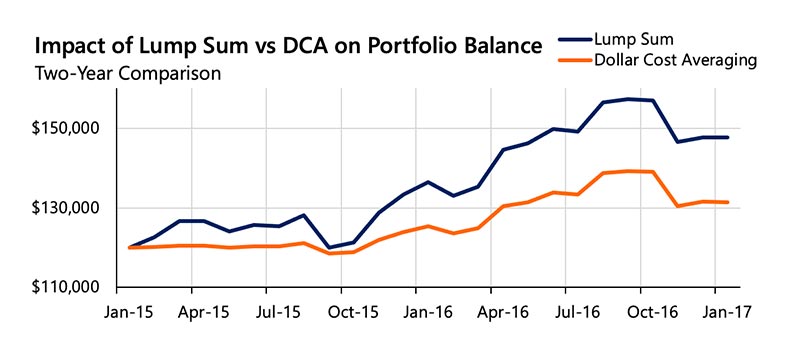

To see how this plays out, we compared two investors each starting with $120,000 in 2015. The Lump Sum investor put all the money in at once, while the DCA investor spread it out by investing $5,000 each month for two years.

We used the SmartShares NZ Top 50 ETF for this analysis, an index-tracking fund that invests in the 50 largest companies on the New Zealand Stock Exchange.

We've charted the monthly portfolio balances of both investors over the first 24 months below. The chart highlights the stable portfolio balance of the DCA investor over the initial buying period, particularly during the first nine months, compared to the more volatile balance of the Lump Sum investor.

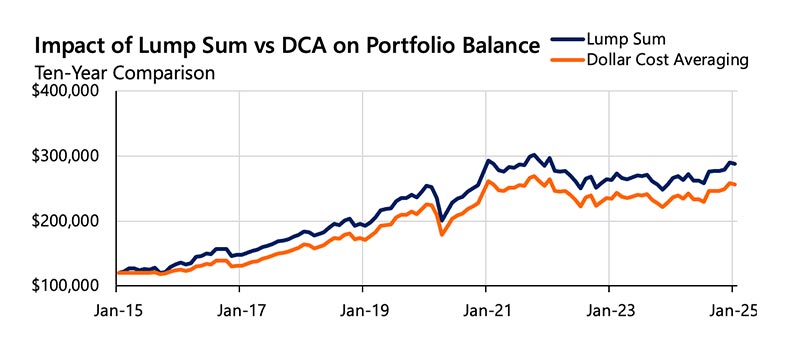

However, even after just 12 months, the Lump Sum investor's portfolio balance is starting to pull ahead. If we zoom out and look at a 10-year period, both investors faced the same market ups and downs, but because the DCA investor had less money working early on, they ended up with smaller overall returns.

After 10 years, our Lump Sum investor saw a total return of 140%, with their initial $120,000 investment now worth nearly $288,000. Our DCA investor saw a good (but more modest) total return of 114%, with their initial $120,000 now worth around $256,000. Even though both invested in the same fund over the same period, the DCA investor finished with $32,000 less – a big cost for avoiding some short-term losses in the early years.

This result aligns with global research, which consistently finds that the lump sum strategy outperforms in most periods and most asset classes because markets generally trend upwards.

DCA does have a place

Despite the analysis above, DCA does have its place. For highly risk-averse investors, spreading investments over time can reduce the stress of short term losses. It can also help new investors build confidence and stay committed to their investment plan.

The bottom line

For most long-term investors, lump sum investing is the smarter move: it gets more money working sooner, captures market growth, and compounds over time. However, the best choice depends on individual risk tolerance, time horizon, and peace of mind.

As the saying goes: "Time in the market beats timing the market."